*T&C Apply.

Signup Now

Ship your

dream

Create a delightful online journey by optimising your

shipping process and everything surrounding it.

A trusted growth partner

Lakhs of eCommerce businesses chose

Shiprocket to streamline their customer

journey-from shipping to returns and beyond

Shiprocket to streamline their customer journey-from shipping to returns and beyond

-

2.5 Lakh+

merchants nationwide

-

20 Crore

transactions every year

-

₹ 30K Crore

annual GMV powered

-

25 Crore

shipments delivered

Enhance your customer experience

at every touch point

Shipping

Keep things simple

Domestic shipping

Manage all channels in a single view and reach nationwide efficiently with AI-based courier selection

Explore

Hyperlocal delivery

Make intra-city deliveries in hours with our experienced courier partners

Explore

Experience Shiprocket in real-time with our live demo. Sign-up not required for demo

Check Live Demo

Exports

Grow beyond boundaries

Ship your orders to over 220+ countries and territories with India’s leading cross border shipping solution

ExploreAccess transparent door-to-door B2B deliveries via air from India to anywhere with no weight restrictions

ExploreTake your brand global and start selling to international customers with minimum investment risk

Explore

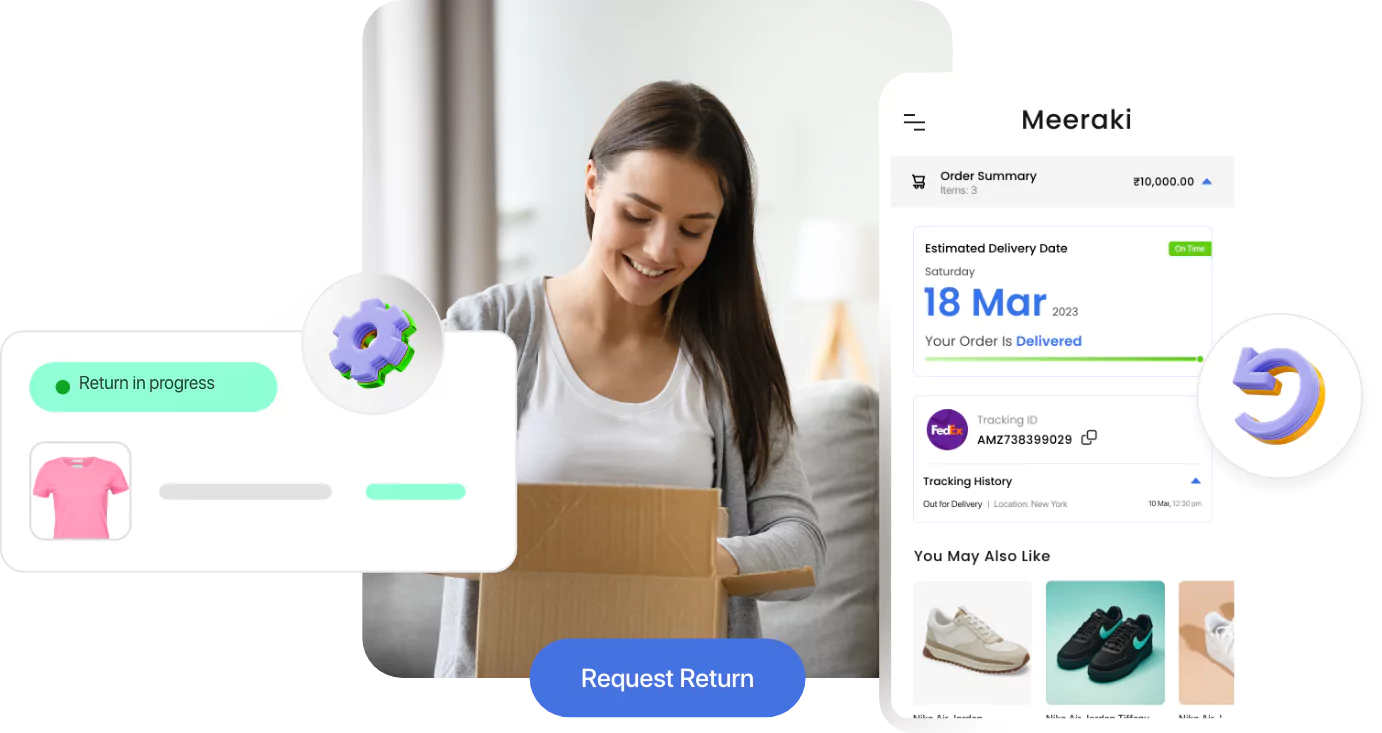

Delight

Elevate customer experience

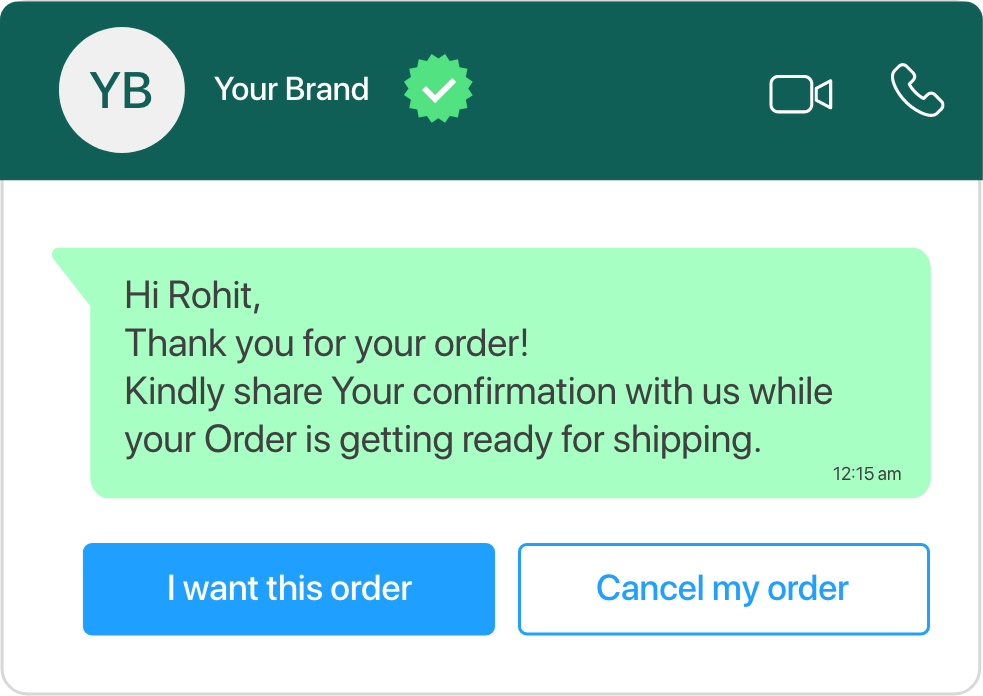

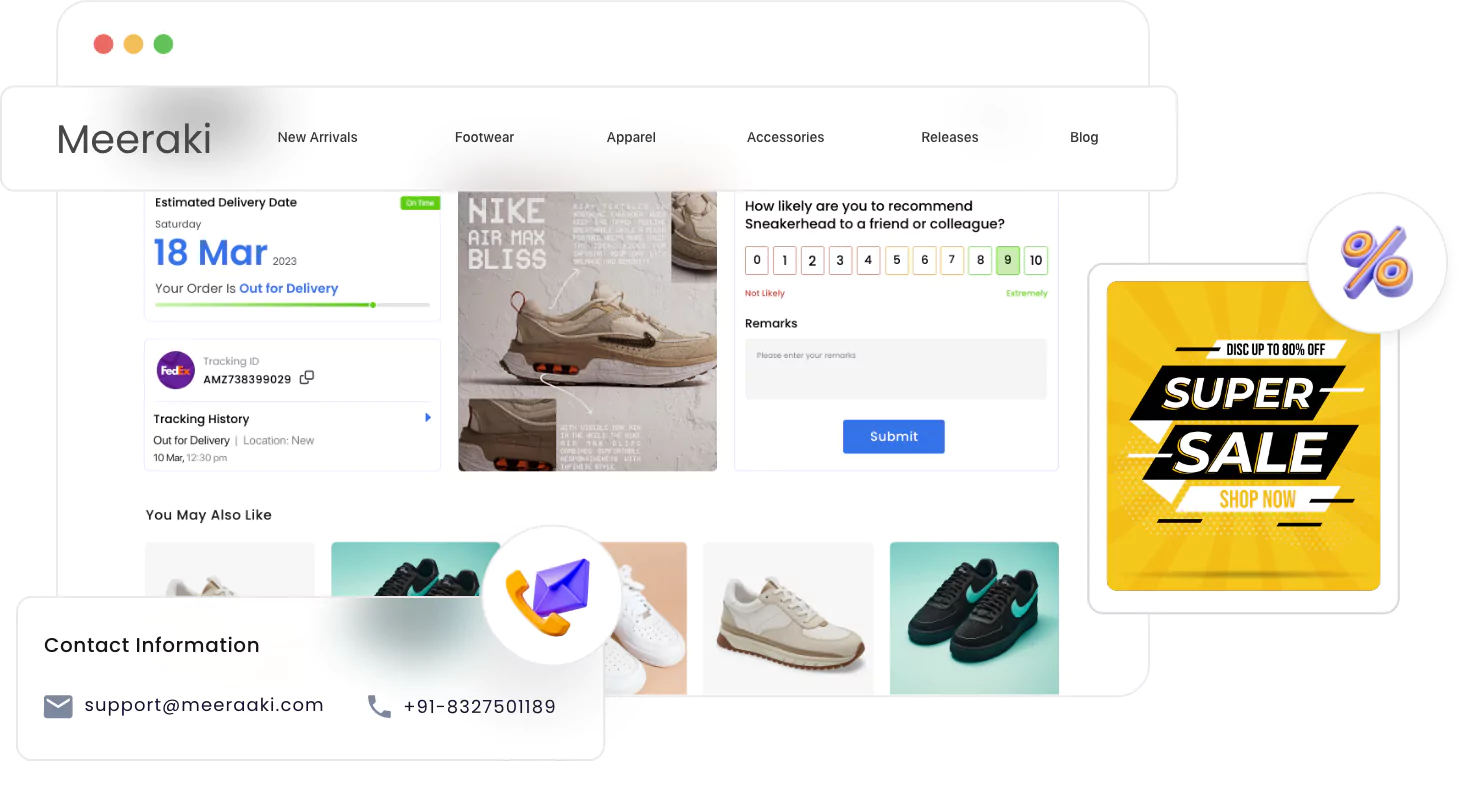

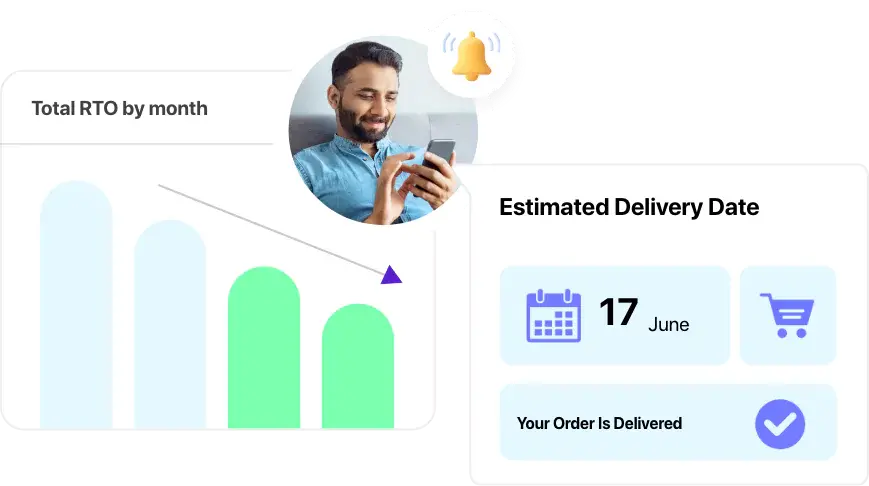

Customer communication

Automate your post-purchase communication and lower your RTO losses by 45%

Explore

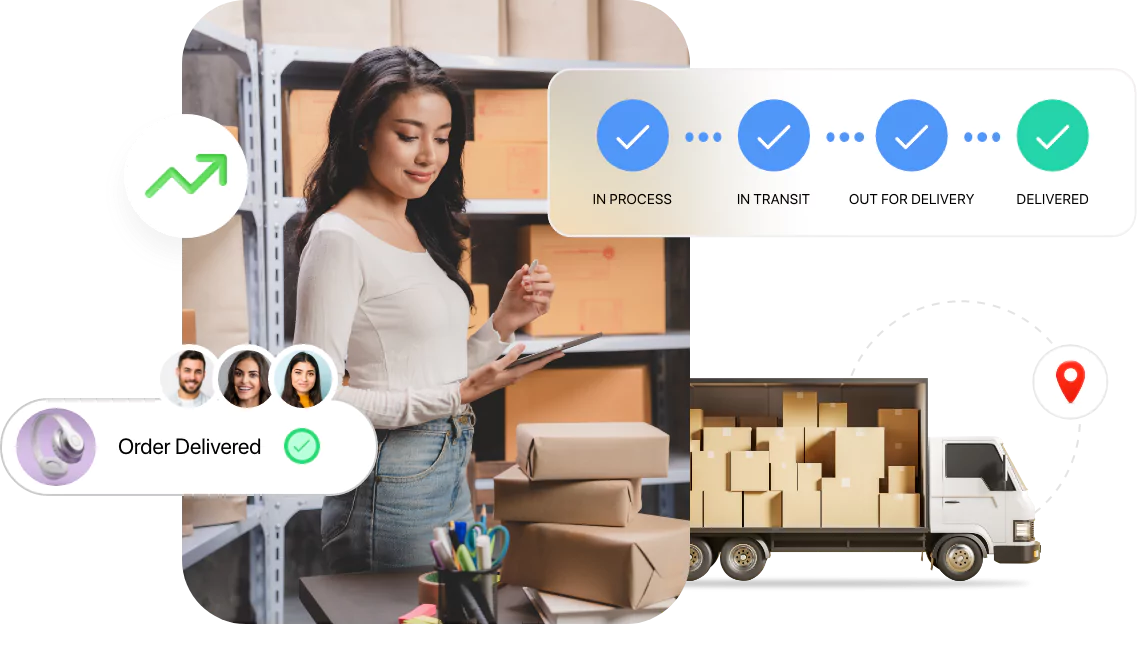

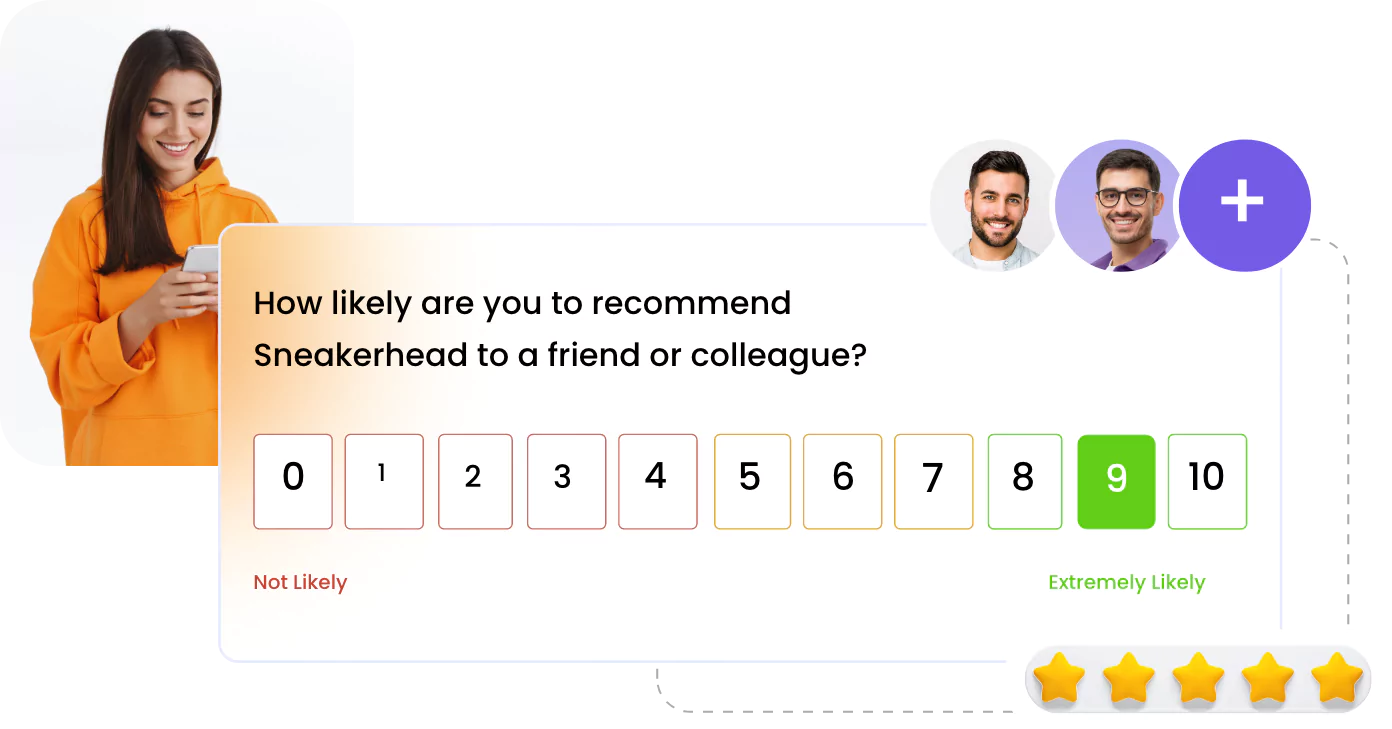

Tracking page

Build trust with your brand name, logo, offers and support details on your order-tracking page

Explore

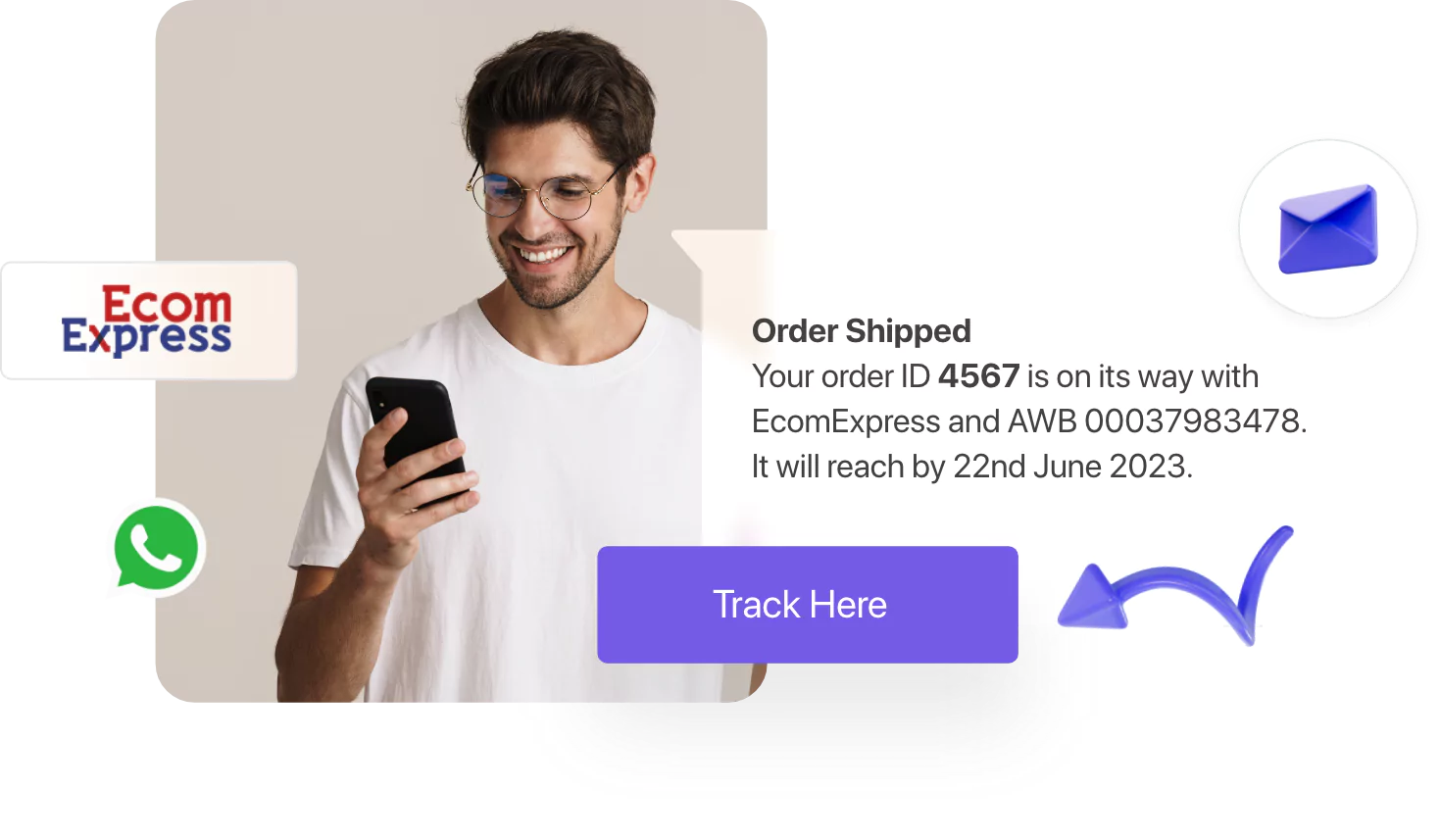

Status alerts

Reassure your customers with real-time tracking alerts through WhatsApp, Email and SMS

Explore

Returns management

Offer easy returns, send regular status updates, and provide instant refunds

Explore

Fulfillment

Fulfill every need

B2C fulfillment

Store inventory closest to your customers & deliver their packages on the same or the next day

ExploreB2B shipping

Fulfill and ship your B2B orders in bulk and on time with our end-to-end solution

ExploreOmnichannel enablement

Connect your warehouses, stores, marketplaces, and website to provide a unified experience

Explore

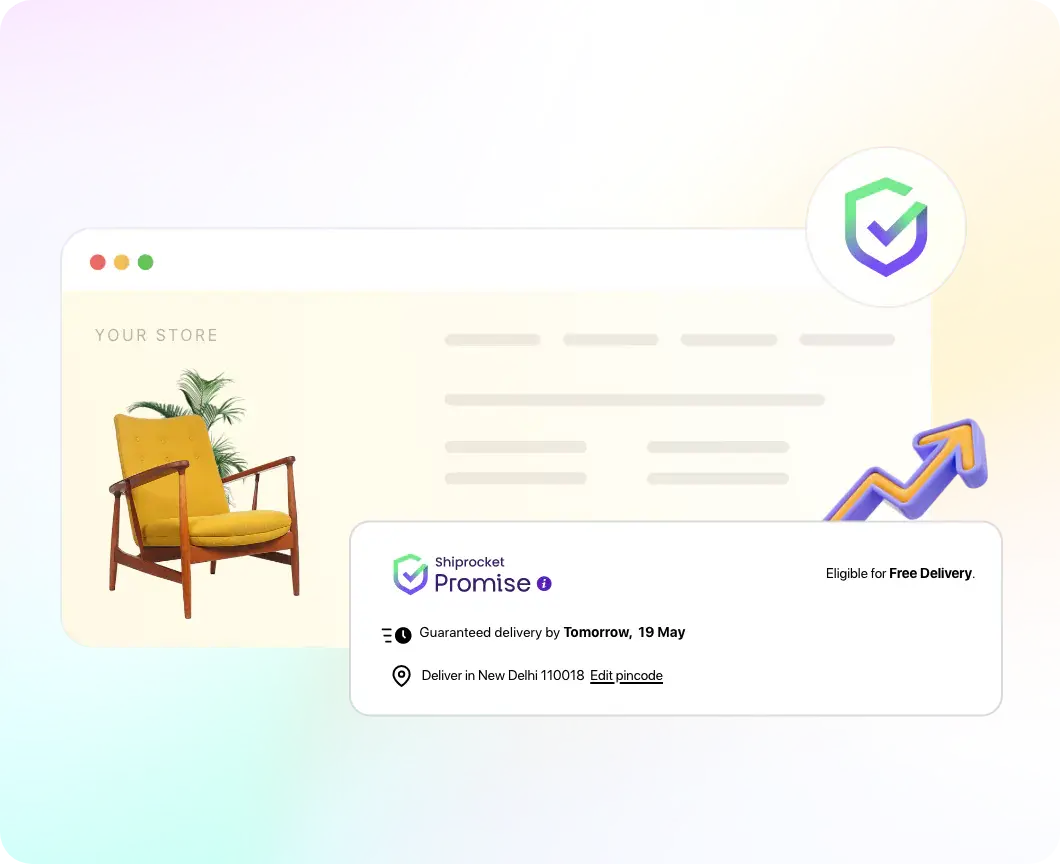

Conversion

Drive repeat purchases

Trust building

Show Shiprocket’s badge of trust throughout your website to boost credibility

Explore

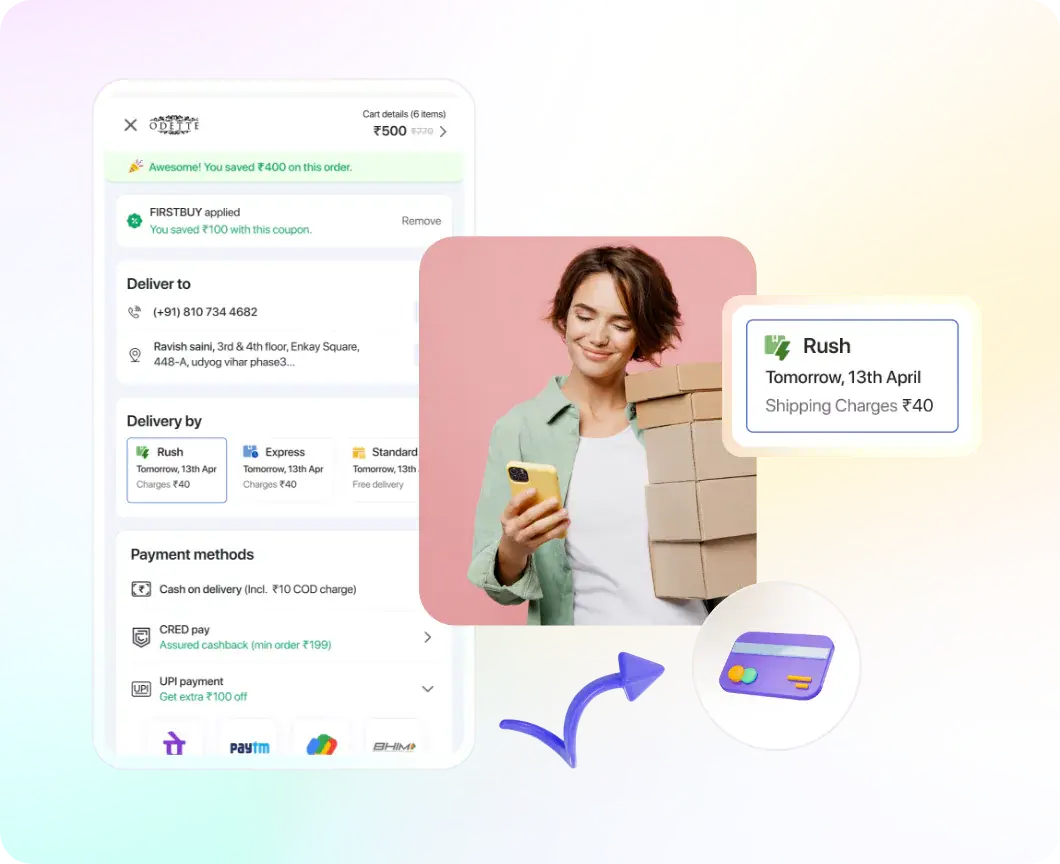

Checkout optimisation

Speed up checkout by 70% with pre-filled details and intelligent fraud detection

Explore

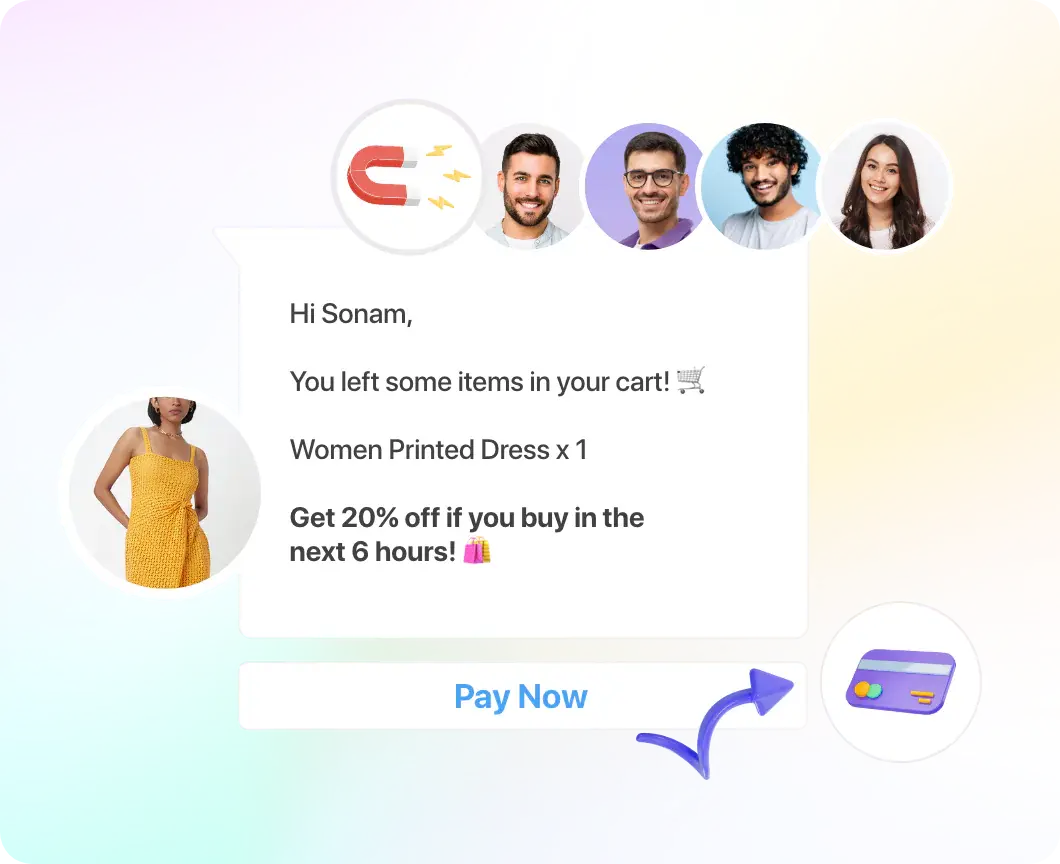

Customer retention

Re-engage with high-potential prospects and increase customer retention by 25%

Explore From anywhere

to everywhere

Our multi-courier network spread across 24000+ pin codes

lets you say yes to every order, even from remote areas.

What makes it all work together

Seamlessly connected components

Use one platform to manage everything, including your sales channels, inventory, catalogues, carriers and customer data

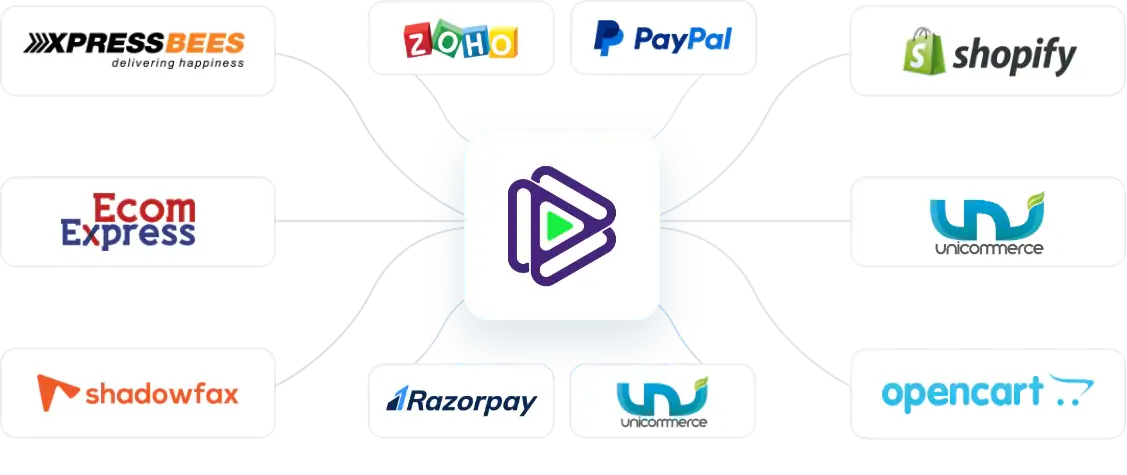

150+ ecosystem integrations

Leverage the largest eCommerce enablement layer of carts, checkout and payment interfaces, courier partners and more

Explore

Over 1 Trillion data points

Be it reducing RTO or improving conversions, utilise our AI-driven analytics to achieve it all smartly

Explore

Tailored business workflows

Respond to the needs of your customers as well as your business just the way you like

Explore

All-around support

Get a dedicated account manager that you can rely on for all your concerns at every step

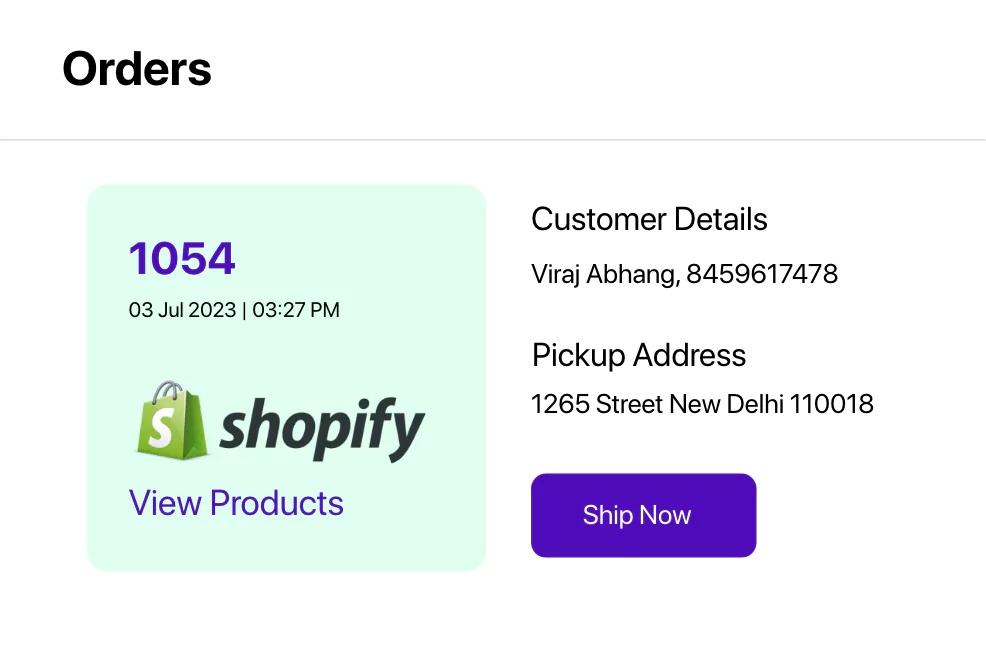

ExploreManage multiple channels in one place

Integrate 12+ sales channels to easily manage your orders, inventory and more

Why we do what we do

-

Ayush

Founder, Car101

It has been about six months since we launched in the market, and the Shiprocket team has been immensely helpful from day one. They’ve assisted us in everything from selecting the right courier partners and securing the best prices to handling escalations and last-mile deliveries. This is a big shout-out to the dedicated account managers and Shiprocket for their unwavering support.

-

Sudheer

Founder, Organicos India

Shiprocket has made our order process cost-effective and seamless with real-time tracking and updates. It saved us time, money, and resources, enabling us to provide maximum benefits to our clients. Shiprocket has been our trusted partner since the beginning, and we highly recommend it to other entrepreneurs.

-

Gorang

Founder, Little Rituals

Shiprocket has not only served as an aggregator helping us transport goods from A to B but has also significantly enhanced our business. Our customers receive updates at every step, the invoicing is paperless, and our return-to-origin (RTO) rate is now less than 1%. The team consistently responds to our queries within 24 hours, making our association commendable.

-

Nikhil Sharda

Dhara Food Products

I want to express my gratitude to Shiprocket for existing in this world of digital technology. The platform’s flexibility allows us to choose from various delivery agencies and partners, ensuring we find the right fit for our needs independently. Without Shiprocket in our country, it would have been challenging to select the ideal delivery partner. I strongly prefer Shiprocket.

-

Rahul Garaval

Co-founder, Prince Street

Our entire revenue comes from online sales, and for the past three years, we have relied completely on Shiprocket for all our shipment needs. Thanks to their support, our shipments reach all parts of the country within just 5 days.

-

Priyanka Gusain

Founder, Zubiya

With Shiprocket, our shipping errors have really reduced. Also, it has become easier for us to integrate our channels, import our orders and ship our products smoothly. I recommend it to every eCommerce store!